Written by Richard Zehr

BBA, CAIB, President, Zehr Insurance

Your Financial Story Matters

As a contractor working to expand your business, your financial statements do far more than satisfy your accountant or lender — they tell the story of your company’s ability to take on and successfully complete construction projects.

Utilizing surety bonds is one of the most effective ways to grow a construction business because bonds signal financial strength, credibility, and reliability to project owners. Many public and large private projects are simply not accessible without bonding.

A strong bond program allows contractors to:

- Bid larger jobs

- Expand into new markets

- Compete for larger opportunities

At the center of that growth is your financial strength, which sureties evaluate using the Three C’s of Surety: Character, Capacity, and Capital. Understanding how your financial statements communicate these qualities helps position your company for sustainable growth and increased work on hand.

The Balance Sheet: A Snapshot of Financial Strength

Your balance sheet is often the first chapter of the financial story because it shows what your company owns, what it owes, and its net worth at a specific moment in time.

Assets — such as cash, accounts receivable, equipment, and work in progress — demonstrate the resources available to operate projects.

Liabilities — including accounts payable, debt, and billings in excess of costs — reflect obligations across both near- and long-term timelines.

The difference between the two — equity — represents the financial health of the organization.

Sureties examine the balance sheet closely to evaluate capital, since working capital and net worth indicate how the company can respond to unexpected challenges such as project delays, cost overruns, or disputes.

A strong balance sheet directly increases surety capacity because it demonstrates the financial resources to support larger projects. It also reveals operational capacity by showing whether sufficient liquidity exists to finance payroll, materials, and subcontractors before progress payments are received.

When presented clearly and consistently, the balance sheet also reinforces perceptions of character by demonstrating disciplined financial management and transparency.

The Income Statement: Profitability and Operational Discipline

The income statement continues the narrative by showing how effectively your company generates profit from operations over time.

It outlines:

- Revenue from construction contracts

- Cost of performing the work

- Overhead expenses

- Net income

Sureties use this statement to assess capacity by determining whether projects are consistently profitable — a strong indicator of effective estimating, cost control, and project management practices.

Profitability fuels growth because retained earnings increase net worth, strengthening capital and allowing your company to take on larger bonded work without overextending.

A steady record of profitability also supports the assessment of character, reflecting responsible leadership and operational discipline rather than reliance on one-time gains.

The Work-in-Progress Schedule: Real-Time Insight into Backlog Health

For contractors, the work-in-progress (WIP) schedule is often the most revealing document in the financial package because it provides a real-time snapshot of active projects.

This schedule includes:

- Contract value

- Costs incurred to date

- Estimated costs to complete

- Billings

- Projected profit for each job

It shows whether projects are overbilled or underbilled and whether they are performing according to expectations.

Sureties rely heavily on this information to evaluate capacity, since it reveals both the size and health of your backlog and whether your team can realistically manage its workload.

A well-managed backlog demonstrates controlled and sustainable growth, increasing confidence in expanding your bond program.

The WIP also affects capital, as underbillings can strain cash flow while overbillings may temporarily strengthen it. Accurate cost estimates and timely adjustments demonstrate character, showing that management understands its projects and proactively addresses risks.

How Accounting Methods Shape the Financial Story

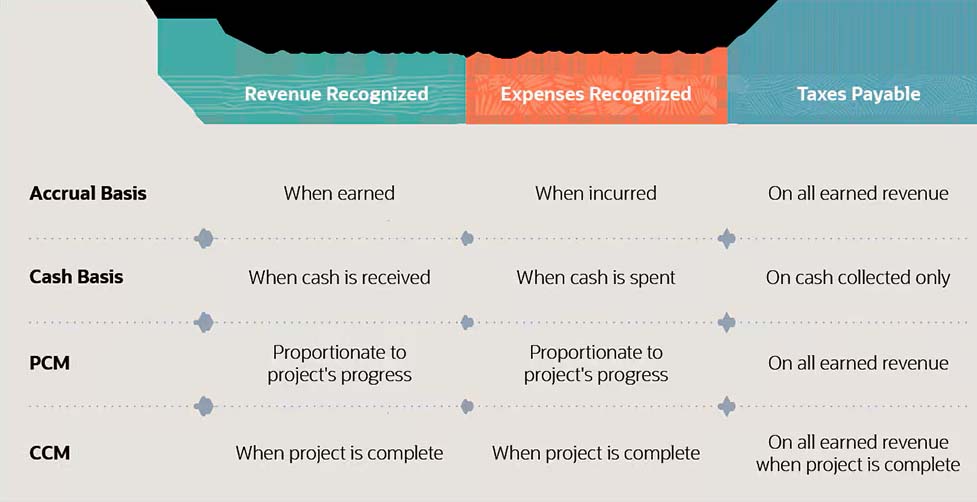

The accounting method used for construction projects significantly shapes how your financial performance is presented to sureties.

Accrual Basis

Revenue is recognized when earned and expenses when incurred.

This approach offers clearer visibility into obligations and receivables.

Cash Basis

Revenue is recognized when payments are received, and expenses when paid.

While simple, it provides limited insight into project performance in progress and may obscure strengths and risks, making it difficult for sureties to evaluate true capacity.

Percentage-of-Completion Method (PCM)

Generally preferred by sureties, this method recognizes revenue and profit as work progresses based on costs incurred relative to total estimated costs.

It provides:

- Real-time visibility into project performance

- Early identification of potential losses

- A steadier buildup of equity

This method strengthens capital, highlights management oversight (supporting character), and provides the clearest assessment of capacity. Contractors using percentage-of-completion often find it easier to increase surety capacity because it offers the most transparent and reliable financial picture.

Completed Contract Method (CCM)

Revenue and profit are recorded only when a project is finished.

Though conservative and helpful in preventing overstated profits, it often results in uneven financial performance and provides limited visibility into projects underway. From a surety’s perspective, it can make evaluating ongoing capacity challenging, potentially limiting bonding growth.

Financial Statements as a Growth Engine

Ultimately, your financial statements function as a comprehensive narrative of your company’s readiness for bonded projects and long-term growth.

They demonstrate whether you have:

- The character to manage work responsibly

- The capacity to complete the projects you pursue

- The capital to withstand unexpected challenges

A strong bond program does more than satisfy project requirements — it becomes a strategic growth engine. It enables contractors to pursue larger contracts, strengthen relationships with project owners, and build a reputation as dependable partners capable of delivering complex projects.

Viewing Financial Reporting as Strategy — Not Obligation

Contractors who view financial statements as a strategic tool rather than a compliance exercise are better positioned to expand bonding limits and grow their businesses simultaneously.

Clear, accurate, and professionally prepared financial reporting sends a powerful message to sureties and project owners alike:

Your company is prepared not only to win bonded work, but to deliver it successfully and continue growing for years to come.

About Zehr Insurance

At Zehr Insurance, we work closely with contractors seeking to present a strong financial position to surety partners.

Surety bonds are not reserved only for large national contracting companies. If you would like to explore bonding facilities and growth opportunities for your business, please contact our office.

Call Zehr Insurance brokers and see if we can help you with your insurance needs.