Written by David Stewart

Business Development & Marketing Manager

Planning for the transition of business assets and operations to the next generation can be a large undertaking for any size business, especially family owned and operated farms.

Succession planning of your business should be a team effort involving the expertise of an accountant, which I am not, to equate for the various tax liabilities and other expenses of the business ownership switching hands and the members of your family to assess their desire for perpetuation and providing options for everyone involved. Also a licensed life insurance broker, like myself, who can detail how a life insurance policy can aid and assist in the financial transition of succession planning.

1. Identity successor(s)

2. Assess Objectives & Goals for all

With the successor identified; family members need to honestly assess the compatibility of each other’s business and personal objectives, goals, and expectations. A strategy to address serious discrepancies and incompatibilities can be developed and these issues overcome.

3. Collect & Analyze Information

- Analyze financial viability & profitability of the farm business

- Review technical information- wills, power of attorney, taxation, and legal issues

- Consider other income, retirement savings, or savings accounts

- Make projections for where the business will be in the future

4. Generate Options

- Ownership transfer through assets being purchased, rented or gifted

- Business organization structures (sole proprietorship, partnership, corporation)

- Tax strategies

5. Make primary decisions

Estate Liquidity or Estate Equalization. After identifying goals and objectives of each person in family; collecting and analyzing information and generating options of where the business is now and where it is going. Life insurance policies can be implemented to protect goals & objectives or each person in the family & business as well as transfer wealth sheltering against tax.

So how can life insurance assist in succession planning?

We can look at the following questions regarding a family run farm:

When is this needed?

A life insurance policy is needed when a person wants to take over the family farm while over siblings have no interest in the business.

Why is this needed?

Typically, the person taking over the family run farm does not (and likely will not in the future) have the necessary capital or equity to buy the farm outright from his parents’ estate. Therefore, the farm may have to be potentially sold to successfully divide the estate amongst all children.

How does life insurance help?

A life insurance policy is purchased that pays out upon the death of the last remaining parent. The beneficiary of the life insurance policy is the child (or children) that has no interest in the farm, or the beneficiary can be the farm itself and then the funds used to buy out the shares of children with no interest in the business.

Example

Let us look at a hypothetical example that is probably a common scenario for most family run farms:

The Situation

- Joe & Betty Smith own and operate a family farm with a current value at $1.8M. They have three children, a son Jake & two daughters, Jane & Jose.

- Joe & Betty are close to retirement with Jake working on the farm and his intentions are to take it over. Jane has moved away and is a nurse. Jose has moved away and is an insurance broker.

- The daughters do not wish to purchase and continue operating the family farm but will need to be compensated for their portion of the inheritance of the farm in the future.

The Solution

- After consulting with an Accountant, a Succession Plan was created and finalized.

- Part of the Succession Plan deemed that Jane & Jose will each need to be paid out 1/3 of the current farm value ($1.8M)

- A Permanent Life Insurance “Last-To-Pass” policy (aka Whole Life) is purchased. This insures both Joe & Betty however only pays out upon the death of last surviving spouse. The amount of insurance purchased is $1.2M ($1.8M divided by three children). The beneficiaries are both Jane and Jose for 50/50 split or $600,000 each.

- The policy is set up in the name of the farm and premiums are paid by the farm, using pre-tax income.

The Result

- Twenty years later Joe passes away. Betty passes away five years later. Upon Betty’s death Jane & Jose are each paid $600,000 from the insurance policy.

- The farm is willed to Jake only.

The Long-Term Ramifications

- At the death of Betty (25 years since the purchase of the life insurance policy) the farm value had increased and is now valued at $3M. Without succession planning and using life insurance, Jake could possibly have had to come up with $2M to buy out his sisters.

- Since Jake had worked hard over the last 25 years, it makes sense that the sisters should have been compensated for the value of the farm at the time their parent’s retirement and not when they passed away 25 years later.

- Essentially, the life insurance premiums Jake (the farm) paid for the policy are offset by the increased value of the property (and more)

- REAL IMPORTANT- The farm stays in the family as Jake is not forced to sell it to divide his parent’s estate.

- MOST IMPORTANT– the three siblings are not on bad terms due to this situation… probably another reason why Joe & Betty set up the Life Insurance policy.

As you can see from the above example, a Permanent Life (aka Whole Life) policy was key in giving Jose & Jane their share of the value of the farm at their parents’ retirement and Jake can keep the farm without having to take out a cumbersome loan or even worse sell a portion of the farm to pay out his siblings.

One important aspect is to understand is how each child got what they needed/were entitled to without having a potential unsettling financial situation burden that could potentially sour future relationships with each other.

Other ways Zehr can help businesses such as Family Farms

In addition to permanent life insurance used for succession planning, Zehr Insurance can aid business owners in other areas including:

1. Using Term Life Insurance as collateral to loans.

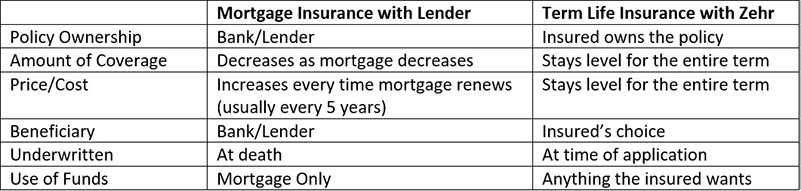

Often small businesses have significant debt and purchase mortgage insurance from their lender. Term life insurance offers much better protection, and it is usually cheaper. Consider the following chart for differences in the two products:

2. Using Disability Insurance to protect your future income.

If an accident, injury, or illness strikes the business owner may be left in a precarious situation by not being able to keep the business afloat. Often with small businesses, the owner is the main income generator of the business. If they can no longer work or need to take significant time off work to recover from an injury or aftermath of a serious illness- how will the business survive?

There are two products that could be of benefit here.

- Standard Disability Insurance. This will insure the business owner’s future income. If they become disabled and cannot work; they would receive 2/3 of their income indefinitely until retirement. Here, the business owner can use the income they would normally pay themselves to hire someone else to run the business until they return.

- Business Overhead Insurance. This insures the business of all fixed monthly costs for up to two years if the business owner is unable to work due to an injury, accident or illness This is a less expensive option than standard disability insurance. This option will allow the business to keep running for two years so the owner can decide to either sell the business if their future health is in question or allow the business owner two years to recover and then return to operating the business. Fixed expenses covered can include anything from rent, utilities, loans and even employee salaries.

3. Group Health Benefits.

Most small business owners are shocked to know that only two employees (owners included) qualify them for group health benefits. Group health benefits are great for the following reasons:

- Plans are customized to whatever suits the business owners needs. They get to choose what coverage they want (drugs, dental, vision, travel, paramedical services, long term disability)

- Business owners choose the limits (or amount of coverage) they want for each section (for example, $1000 of dental coverage per person per year)

- All employees and their families are covered regardless of their health… pre-existing medications, conditions are automatically covered.

- Premiums are a taxable business expense.

Lastly…

Whether it be succession planning, term life insurance to protect against a loan, protecting your income in the future from risk of injury or illness with disability insurance or providing your family and your employees with health benefits, a licensed Zehr Insurance broker can assist you with all your needs.

As our motto suggests, we are here to “Protect What Matters to You”.

Call Zehr Insurance brokers and see if we can help you with your insurance needs.