Written by Chris Cameron

Branch Manager, Mitchell Office

The consequences of climate change are reverberating across the globe, reshaping industries and leaving no sector untouched. In Ontario, the insurance industry, particularly home insurance, is undergoing a significant transformation due to the increasingly evident impacts of climate change.

In this post, we’ll explore how climate change is influencing home insurance premiums in Ontario and provide detailed insights into how AI is playing a pivotal role in risk assessment, loss prevention, and mitigation efforts.

Increased Frequency and Severity of Extreme Weather Events

According to reports and publications from Environment and Climate Change Canada, the number of extreme weather events in Canada has increased significantly over the past decade, with 2020 alone witnessing 27 such events.

Risk Assessment and Underwriting Challenges:

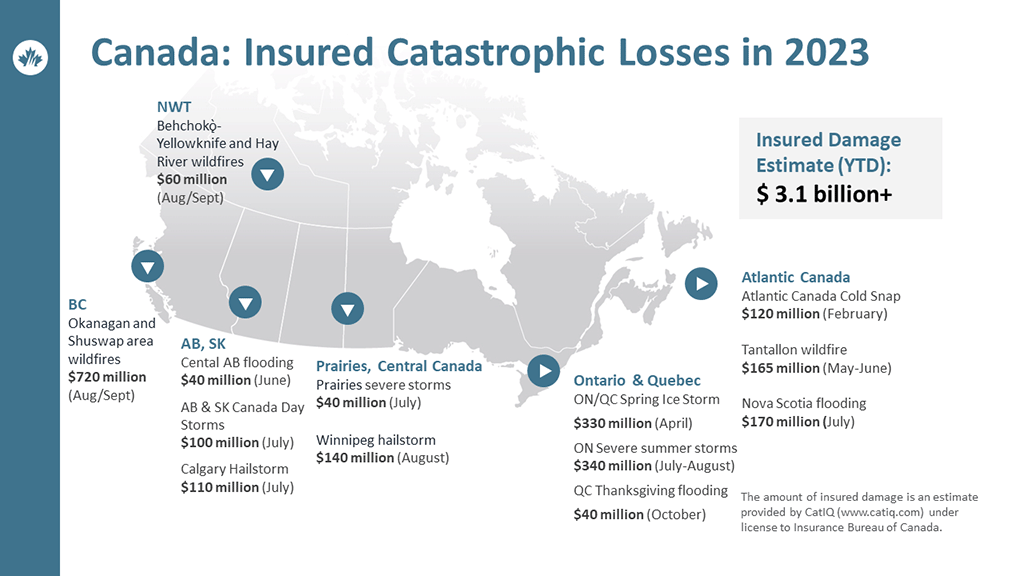

- Insights from the Insurance Bureau of Canada indicate that insured losses from natural disasters in Canada reached $3.1 billion in 2023, with a significant portion attributed to severe weather events.

- AI algorithms can help analyze historical weather patterns, satellite data, and climate models to enhance risk assessment accuracy.

Rising Costs of Rebuilding and Repair

- The Canadian Institute of Actuaries notes that the annual average economic losses from extreme weather events in Canada could reach $43 billion by 2050, underscoring the financial strain on insurers.

- AI-driven predictive analytics, as reported by [Insurance Technology Publications], assist insurers in assessing potential future losses based on climate projections.

Loss Prevention Measures and Mitigation Efforts

- According to materials from the Insurance Bureau of Canada, investing $1 in disaster risk reduction could save $6 in future disaster response costs, highlighting the importance of proactive measures.

- AI-powered risk mitigation solutions use real-time data, satellite imagery, and machine learning to identify vulnerable areas and recommend preventive measures.

- AI can be used for predictive analytics to estimate the likelihood and severity of future climate-related events. This information allows insurers to adjust their risk models and set appropriate premiums based on the evolving climate conditions.

- The Provincial government sets aside funds to allocate towards loss mitigation such as repairs to roadways, bridges, and other public assets.

Regulatory Responses and Policy Changes

- Government statements and regulatory documents, possibly from the Ontario Ministry of Finance or relevant regulatory bodies, indicate how policymakers are responding to the impact of climate change on insurance.

Adapting Home Insurance in Ontario: AI’s Role in Combatting Climate-Induced Risks

The increased frequency and severity of weather events in Ontario are undeniably reshaping the home insurance landscape. As homes face a growing risk of damages from floods, wildfires, storm surges, hailstorms, and extreme winter weather, insurance claims are on the rise. Insurers must adapt to these changing patterns by reevaluating risk assessments, adjusting coverage options, and exploring innovative solutions to ensure homeowners are adequately protected in the face of a shifting climate.

In the face of escalating climate change in Ontario, AI emerges as a powerful ally for insurers. From refining risk assessments to guiding loss prevention strategies and aiding in proactive mitigation efforts, AI is instrumental in navigating the complex landscape created by extreme weather events. As the insurance industry adapts to a changing risk environment, the integration of AI technologies proves crucial in enhancing resilience, ensuring accurate risk pricing, and ultimately safeguarding homes and communities against the unpredictable consequences of climate change.

Call Zehr Insurance brokers and see if we can help you with your insurance needs.